- #QUICKBOOKS SMALL BUSINESS ACCOUNTING TUTORIAL HOW TO#

- #QUICKBOOKS SMALL BUSINESS ACCOUNTING TUTORIAL FULL#

- #QUICKBOOKS SMALL BUSINESS ACCOUNTING TUTORIAL SOFTWARE#

If you don’t need to collect sales tax or generate a lot of invoices, consider accounting software like Wave or Momenteo.

Basic needs: If you run a small business as a freelancer and your income is modest, a simple Excel spreadsheet can easily handle your expenses and income. Here are a few needs scenarios and accounting software choices to consider for small businesses in Canada: The Business Development Bank of Canada’s list of accounting software includes free options and made-in-Canada products that offer French versions. #QUICKBOOKS SMALL BUSINESS ACCOUNTING TUTORIAL FULL#

They cover a full range of software options, from affordable or free options for freelancers to robust packages for larger incorporated SMEs. See PC Magazine’s list of top accounting software or financesonline for detailed reviews. Most accounting software for small business is available as an online subscription service. It depends on the type and size of the business. Your accounting needs might be simple or complex.

#QUICKBOOKS SMALL BUSINESS ACCOUNTING TUTORIAL HOW TO#

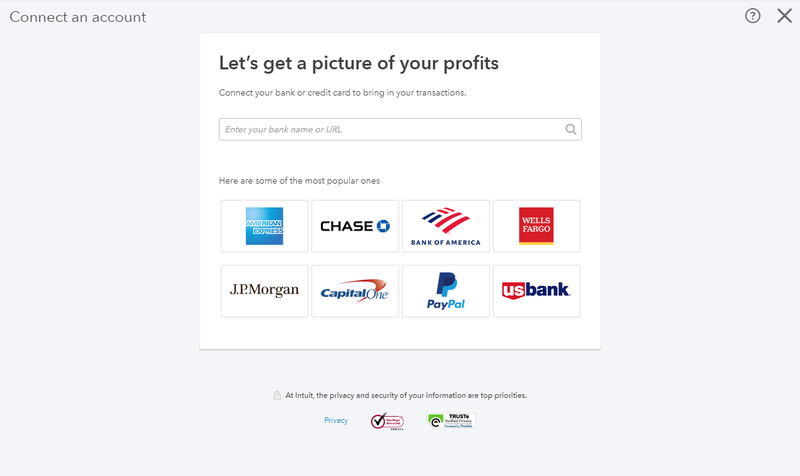

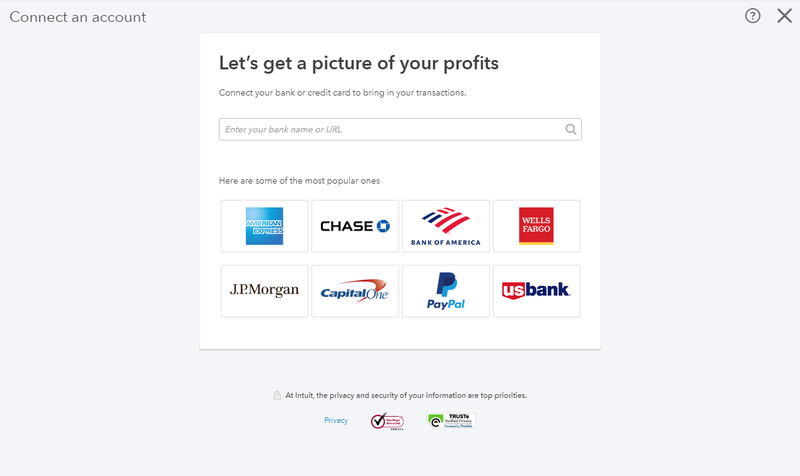

How to choose the right accounting software for your business? If you prefer to do at least part of the work, ask your accountant which software they recommend. If working with numbers isn’t your idea of fun, seek help from a professional accountant or bookkeeper.

Stay on top of tax payments: Accounting software automatically calculates taxes and helps you make sales tax payments on time. Keep track of mileage: Some software lets you track your business drives on your smartphone and export location data.

Build accounting into your business: That way, you’ll have the numbers you need to make decisions at your fingertips. Track performance and automate tasks like invoicing. Get organized: Keep accurate records of expenses and enter sales and expenses into software as they occur. If your small business is a two-partner operation, avoid software that targets larger incorporated businesses. Use the right accounting software: Your needs should determine the right software for you. Here are some tips to help you maximize your accounting tasks and software use: More sophisticated products include payroll, inventory, analytics and other modules. Small business accounting software comes with different features. Track time, mileage and other business expenses. Pay bills from suppliers and pay your employees. The right accounting software should fit your budget and needs. It shows you how you’re doing and where you’re spending your money. More than ever, it helps you do more with less work and knowledge. Read on to find out which accounting software is best for your business.Īccounting software is powerful. It keeps track of your business and pinpoints problems. It gives you insight to make important decisions. Accounting software does a lot more than bookkeeping. And numbers tell the truth about a small business’s performance.

Build accounting into your business: That way, you’ll have the numbers you need to make decisions at your fingertips. Track performance and automate tasks like invoicing. Get organized: Keep accurate records of expenses and enter sales and expenses into software as they occur. If your small business is a two-partner operation, avoid software that targets larger incorporated businesses. Use the right accounting software: Your needs should determine the right software for you. Here are some tips to help you maximize your accounting tasks and software use: More sophisticated products include payroll, inventory, analytics and other modules. Small business accounting software comes with different features. Track time, mileage and other business expenses. Pay bills from suppliers and pay your employees. The right accounting software should fit your budget and needs. It shows you how you’re doing and where you’re spending your money. More than ever, it helps you do more with less work and knowledge. Read on to find out which accounting software is best for your business.Īccounting software is powerful. It keeps track of your business and pinpoints problems. It gives you insight to make important decisions. Accounting software does a lot more than bookkeeping. And numbers tell the truth about a small business’s performance.

What is accounting software?Īccounting is the language of business. Your accounting software helps you get the job done quickly and efficiently, whether you’re at your desk or on your phone. But the right financial tools can save you time, money and frustration. As a business owner, is doing accounting and paperwork your favourite way to spend time at the office? Didn’t think so.

0 kommentar(er)

0 kommentar(er)